- Flat-rate taxation – where the state determines your monthly expenses for tax and social contributions

- Self-taxation1 – keep your business books and pay 10% on taxable profit at the end of the business year

If planned turnover is less than 6.000.000,00 dinars and if the activity for which the flat-rate taxation is possible, then the future entrepreneur should make economic calculation.

And generally the question is: What kind of taxation could bear less expenditure?

In response to this question, it can be very usefull to use our calculator for entrepreneurs.

To get an approximate comparison, you need to have the following information:

- The amount of the annual amount of lump-sum income for your business (the proposal is to contact the Tax Administration and inform about the assumed amount of income),

- Expected operating costs that you will incur during the year (costs related to making a product or service, expenses for an accountant, utility services, fees, etc.) – required for self-taxation,

- Assumption of annual income – required for self-taxation,

- The amount of monthly base for personal income2 (the minimum monthly base is about 23,000.00 dinars and 99% of entrepreneurs decide exactly for this amount of gross personal income because it means the least amount of social contributions) – so it is expected that you will enter here the amount of 23.000,00 dinars 00 dinars

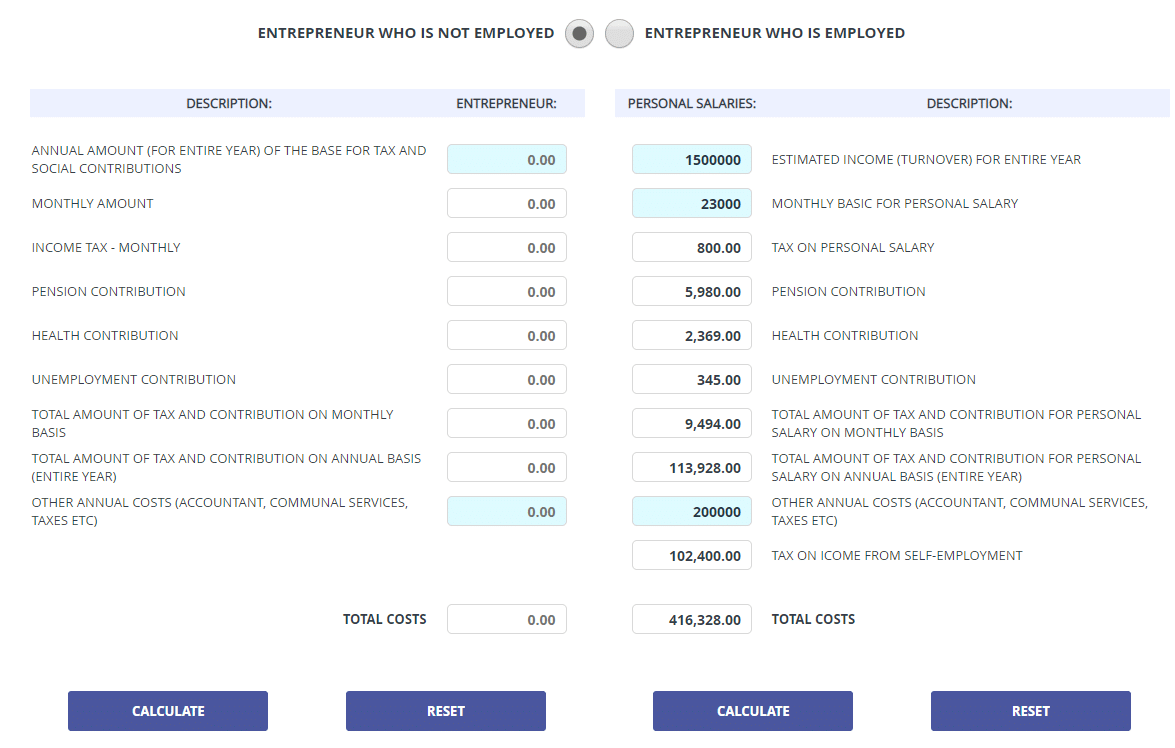

When you collect the necessary informations, enter them in the unlocked fields and you will receive a comparative overview of the expenditures.

Example of entrepreneur with activity code 62.01 in the territory of the municipality of Novi Sad

- The annual amount of lump-sum income is about 696.000,00 (monthly 58.000,00 dinars)

- The assumed costs per year are about 200.000,00 dinars (for accountants, electricity, leasing, computer equipment, etc.) – the same costs for flat-rate and self-taxation have been put in place, although the costs of the accountant are certainly higher for the taxpayer who keeps the business books

- The assumed annual turnover is 1.500.000,00 dinars

- Monthly base for personal income – the lowest selected – about 23.000,00 dinars

When we entered these data in the table we got the following result:

As a result, in case of fulfilling the assumptions, self-taxation would bear less expenditure for the respective entrepreneur (416,328.00 < 532,688.00)3.

Still, it should be considered that the pension contribution, as well as the contribution to unemployment in the lump-sum (flat-rate), is greater than in self-taxation, which in the future may have an impact on the amount of the pension and unemployment benefit.

Notes::

1 If the taxable profit is over 20,000.00 EUR, you will become a taxpayer of annual income tax for citizens – more at https://aktivasistem.com/news/godisnji-porez-na-dohodak-gradjana

2 There is a possibility of deciding not to pay personal earnings, but for us it is an extremely illogical option that can cause significant costs for social contributions in case of positive result at the end of the business year.

3 If a person is already employed for both options, the costs of contributions for health and unemployment should be deducted (multiplied by 12 months), which can change the final result. – use the option “entrepreneur who is employed”